Stock portfolio risk calculator

Ad Go From Rookie to Guru. Simply divide your dollars risked by your risk percentage.

Alpha And Beta Of Investment Portfolio What Is Its Utility Getmoneyrich

This may seem low to you if youve read that the stock market averages much higher returns over the course of decades.

. Calculate Four Measures Used for Stock Risk Analysis and See What They Have in Common Here we simplify financial risk management of stocks using variance standard. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. They are designed to optimise the risk return relationship including currency considerations. Online Value At Risk Calculator for Portfolio Online Value At Risk Calculator for Portfolio Guide How-to Specify StockETFCryptos quantities to instantly view Value at Risk VaR for.

RP w1R1 w2R2 Lets take a simple example. Ad Position Market Products Construct Portfolios And Analyze Mutual Fund Ratings. 5 Estimate the value at risk VaR for the portfolio by subtracting the initial investment from the calculation in step 4.

Start Your Demo Today. Well the SmartAsset investment calculator default is 4. Compare the past risk and return of your current investments to the IFA Individualized Index Portfolio recommended at the end of your Risk Capacity Survey the SP.

Quality Asset Allocation Models For Investment Professionals. Im looking for safety first. Portfolio Risk sqrt 04 2 15 2 06 2 2 2 2 04061520-1 Portfolio Risk sqrt 036 Portfolio Risk 06 This implies that the portfolio risk is 06 or 60.

Finally we can calculate the VaR at our confidence interval var_1d1. Free Online Classes Open an Account Today. The weights of the two assets.

Ad The Definitive Guide to Retirement Income from Fisher Investments. Ad Let Us Manage a Direct Indexing Portfolio For You Or You Manage Your Own Theme-Based Model. If you buy a stock at 50 your stop triggers at 46 or 4650.

Risk contributions volatility beta value at risk VaR maximum drawdown correlation matrix and intra-portfolio. This portfolio optimizer tool supports the following portfolio optimization strategies. Mean Variance Optimization Find the optimal risk adjusted portfolio that lies on the efficient.

Risk contributions volatility beta value at risk VaR and maximum drawdown estimates help you understand your existing. A New Way To Invest In A Tailored Portfolio of Stocks. This calculator is designed to calculate the expected return and the standard deviation of a two asset portfolio based on the correlation between the.

This calculator is a guide to help you design investment portfolios for five different levels of risk. The following table gives the computation of the. Learn 7 ways to generate income in retirement with investing strategies from this guide.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. InvestSpy provides you with free access to. Our Resources Can Help You Decide Between Taxable Vs.

Ad Explore Our Insights on the Factors Driving Inflation and Recommendations for Portfolios. That gives you a position size of. Calculator The calculator below provides key investment portfolio risk metrics.

Risk or variance on a single stock. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Next determine your position size.

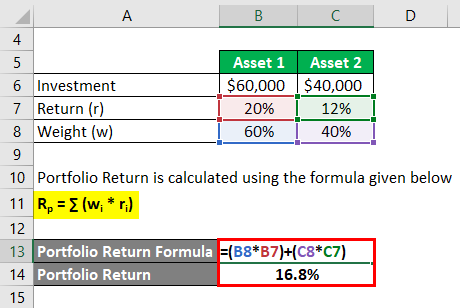

Risk Return for a Two Asset Portfolio. The variance of the return on stock ABC can be calculated using the below equation. You invested 60000 in asset 1 that produced 20 returns and 40000 in asset 2 that produced 12 returns.

Learn More About the Different Ways to Address Inflation in Your Portfolio. Do It Yourself or Get Help From Us. The IFA Index Calculator.

If you dont want to take any risk with your money you should probably look to put your money in cash however you need to be aware that there is limited chance of. The Portfolio Calculator is an interactive tool designed to help investors customize a portfolio to their unique target exposure to equity index price movements and dividend cash flow.

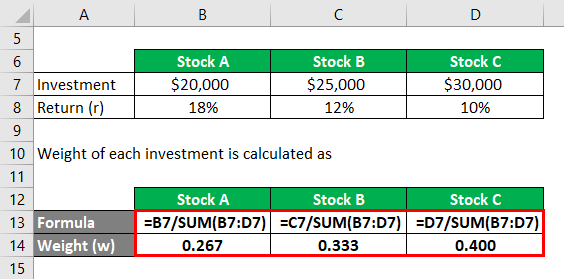

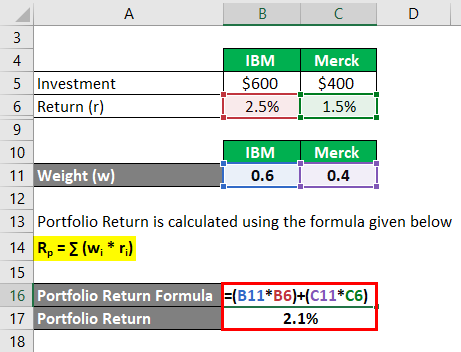

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

The Proper Asset Allocation Of Stocks And Bonds By Age

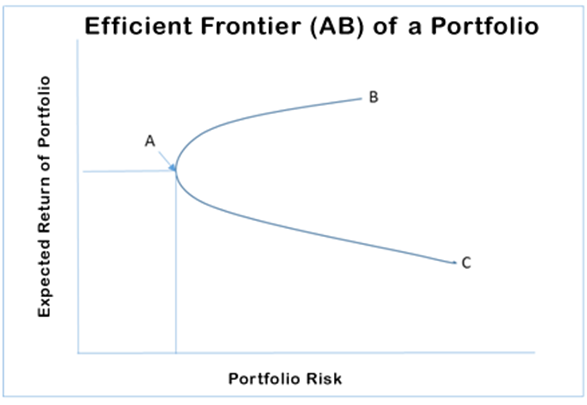

Modern Portfolio Theory Efficient And Optimal Portfolios The Efficient Frontier Utility Scores And Portfolio Betas

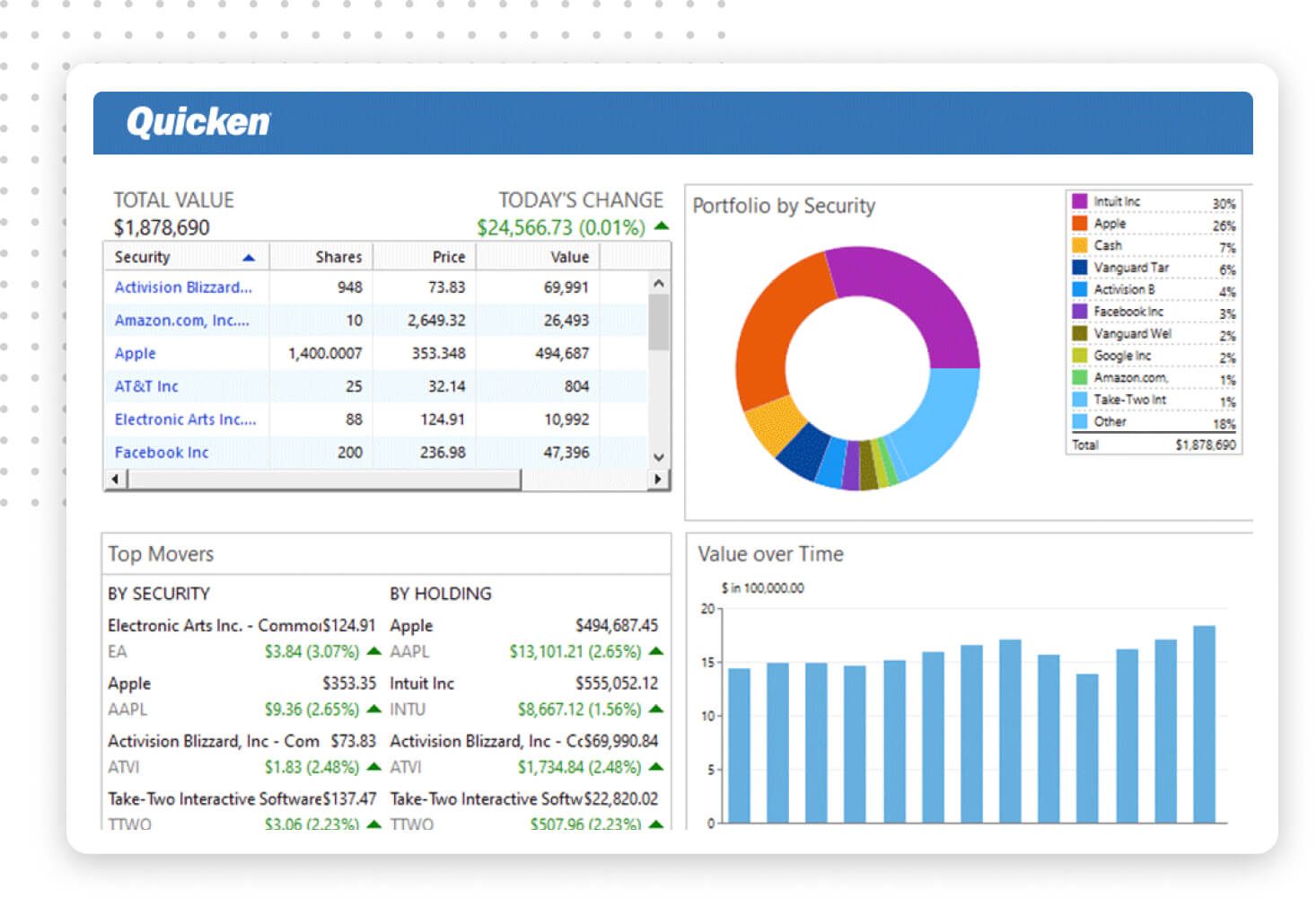

4 Best Portfolio Tracking And Analysis Tools For 2022

Quicken Investing Management Software Track Your Investments Today

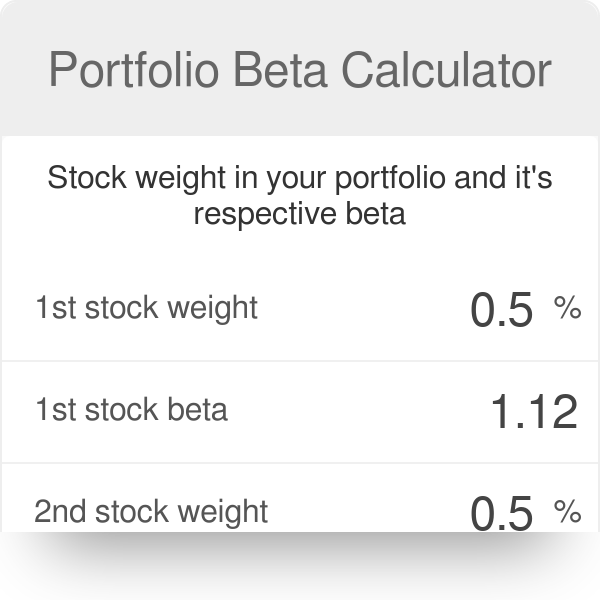

Portfolio Beta Calculator

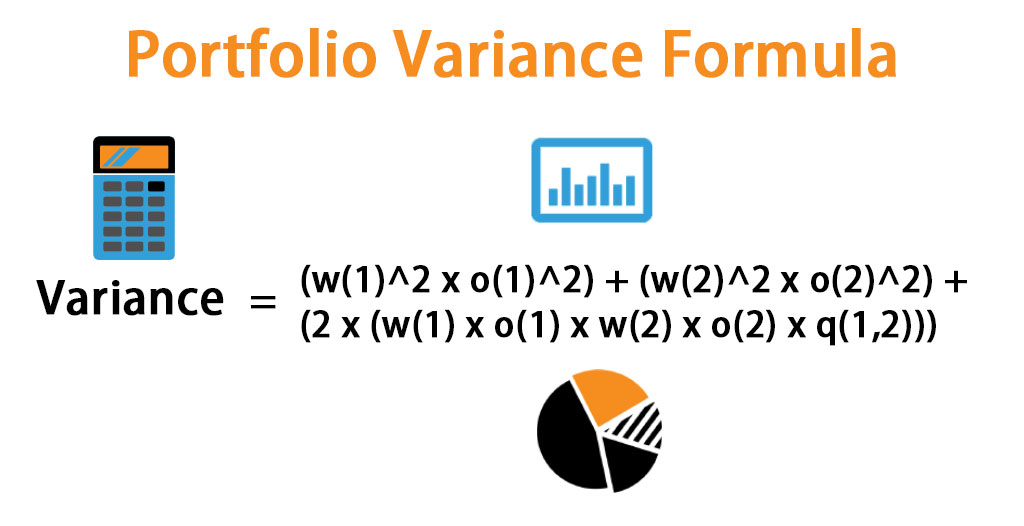

Portfolio Variance Formula How To Calculate Portfolio Variance

Portfolio Return Formula Calculator Examples With Excel Template

The Proper Asset Allocation Of Stocks And Bonds By Age

Modern Portfolio Theory Efficient And Optimal Portfolios The Efficient Frontier Utility Scores And Portfolio Betas

The Risk Aversion Coefficient Desjardins Online Brokerage

Modern Portfolio Theory Efficient And Optimal Portfolios The Efficient Frontier Utility Scores And Portfolio Betas

Asset Allocation The Ultimate Guide For 2021

Historical Returns Of Different Stock And Bond Portfolio Weightings

Which Type Of Investment Has The Lowest Risk Experian